Account of Profits, Infringement of Registered Designs - Bei Yu Industrial Co v Nuby (UK) LLP

Intellectual Property Enterprise Court (Nicholas Caddick QC) Bei Yu Industrial Co v Nuby (UK) LLP [2022] EWHC 652 (IPEC) (22 March 2022)

This was an account of profits. In the Chancery Division which deals with most intellectual property claims infringement proceedings take place in two phases. There is a hearing known as a "trial" to determine whether the right has been infringed and by whom. In the Intellectual Property Enterprise Court or IPEC that takes place some 15 months or so after the issue of the claim form. If the claimant is successful at trial, the court usually orders the defendant to stop the infringement on pain of imprisonment or other punishment for disobedience.

If the successful claimant so wishes, the court will then decide how much money the defendant should pay him or her for the past infringement. Claimants have a choice. They can request compensation for the loss or damage they may have sustained as a result of the infringement known as "damages" or they can require the defendant to disgorge the profits that he or she has obtained from the wrongdoing. The hearing to determine damages is known as an "inquiry as to damages". The hearing to determine the defendant's profits is known as an "account of profits."

Inquiries as to damages and accounts of profits are fairly rare. Most intellectual property claims are settled long before they get to trial. Most of the ones that are left are settled soon after trial. Claimants may choose an inquiry as to damages or an account of profits but not both. Sometimes the claimant's loss and damage exceed the defendant's profits in which case the claimant will choose an inquiry. At other times it is the other way round. To help claimants decide between the two they can require the defendant to supply information about the infringements which is verified on oath As most defendants deny that they have made anything at all from their wrongdoing claimants tend to opt for inquiries. Consequently, accounts of profits are even rarer than inquiries as to damages.

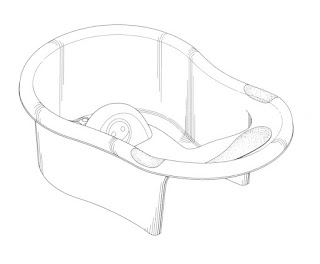

In Bei Yu Industrial Co v Nuby (UK) LLP [2022] EWHC 652 (IPEC) the claimants sought an account of profits for the infringement of registered Community design number 001553701-001 until 31 Dec 2020 and the corresponding registered design number 9001553702001 thereafter, The claimant had registered the design of a baby bath which the defendant admitted infringing. After receiving information about the infringement the claimant opted for an account of profits. The proceedings came on before Mr Nicholas Caddick QC on 8 March 2022. The learned deputy judge handed down his judgment on 22 March 2022.

Mr Caddick summarized the legal principles at para [5]:

"a. The purpose of the account of profits is to deprive Nuby of the profits which it has improperly made by its wrongful importation and sale of the Nuby Baby Bath and to transfer those profits to Bei Yu – see Hotel Cipriani v Cipriani Grosvenor Street [2010] EWHC 628 (Ch) per Briggs J at [8]. In this regard, it is Nuby's actual profit that the court has to identify rather than the profit that Nuby could or ought to have made. In effect, Bei Yu must take Nuby (and its profit) as it is – see Jack Wills Ltd v House of Fraser (Stores) Ltd [2016] EWHC 626 (Ch), at [10]).b. The relevant profits are the sum left after deducting Nuby's allowable expenses from the sums received or receivable by Nuby in respect of its infringing acts.

c. The allowable expenses will include any costs that were associated solely with Nuby's infringing acts. Those costs might be direct costs (e.g. the costs of purchasing and importing the relevant products) or any increased overheads specifically related to the infringing acts. Such expenses may be deducted in their entirety – see OOO Abbott v Design and Display Ltd [2017] EWHC 932 (IPEC), per HHJ Hacon at [57(1) and (2)].

d. The allowable expenses can also include a proportion of Nuby's general overheads unless (a) the relevant overhead would have been incurred anyway (i.e. it would have been incurred even if the infringing acts had not occurred) and (b) the sale of infringing products would not have been replaced by the sale of non-infringing products – see OOO Abbott per HHJ Hacon at [57(3)].

e. Where a deduction can be made in respect of a general overhead, the amount deducted is such proportion of the overhead figure that can fairly be attributed to Nuby's infringing activities as opposed to its non-infringing activities. This apportionment is done on a broad brush basis - see Jack Wills at [53]. However, it may be appropriate to use different bases of apportionment for different types of overhead. A basis that is fair and appropriate in relation to, for example, an expense relating to the business premises may not be fair and appropriate when applied to, say, wages - see Jack Wills at [53]. As noted by Lewison LJ in OOO Abbott [2016] EWCA Civ 95 at [39], the question posed by the court as regards deductible overheads is a relatively simple one to ask, even if it may not be easy to answer.

f. The evidential burden rests on Nuby to support a claim that it is appropriate to make a deduction on account of a sum said to be an allowable expense under the principles set out in (b) to (e) above – see OOO Abbott [2017] EWHC 932 (IPEC) at [57 (4)]."

"The guidance to be derived from these cases includes the following:

(1) Interest is awarded to compensate claimants for being kept out of money which ought to have been paid to them rather than as compensation for damage done or to deprive defendants of profit they may have made from the use of the money.

(2) This is a question to be approached broadly. The court will consider the position of persons with the claimants' general attributes, but will not have regard to claimants' particular attributes or any special position in which they may have been.

(3) In relation to commercial claimants the general presumption will be that they would have borrowed less and so the court will have regard to the rate at which persons with the general attributes of the claimant could have borrowed. This is likely to be a percentage over base rate and may be higher for small businesses than for first class borrowers.

(4) In relation to personal injury claimants the general presumption will be that the appropriate rate of interest is the investment rate."

Anyone wishing to discuss this case may call me on 020 7404 5252 during office hours or send me a message through my contact form.

Comments